4 種收入管道,但最終目標是資產擁有權

2025 Jun 18 金錢思維

這週我閱讀《持續買進》,書中內容大分兩部分:儲蓄、投資

⠀

當我閱讀完第一部分:儲蓄

我對書中「如何增加收入」,印象深刻。

⠀

(正確來說,應該是「聽完」,因為最近喜歡上聽有聲書,哈!但我同時也有電子書,所以當我在跑步機上聽完後,有好奇想了解更多時,就回家打開電腦搭配電子書再讀一遍,這是我目前閱讀的方式)

⠀

好,回到正題。

⠀

作者提出四種賺錢方法後,更直接明說不要把這些賺錢方式當作終點,因為這些都是暫時性策略,目標是增加收入後,把錢拿去投資更多的「生財資產」。

⠀

無論是投資自己的事業還是別人的事業,思維要從「人力資本」轉成「財務資本」,這樣才能創造長期財富。

⠀

這對我來說是一個非常重要的提醒!

⠀

不然真的一不小心,一直鑽在工作本身,忘記後面更重要的思維轉變與投資。

⠀

⠀

▋儲蓄與增加收入的關係

⠀

當你是在收入低的狀況,想存更多錢,最簡單粗暴的方法就是「增加收入」。

收入低就別再往節流方向走!而是開源!

沒錢還一直節流,會讓生活品質更差,人容易會厭世無力,更沒有賺錢的能量,又更沒錢,進入惡性循環。

⠀

⠀

▋儲蓄與投資的關係

⠀

你若沒儲蓄,那麼無論你學再多投資知識、再有意願想投資,甚至還想做資產配置,希望透過複利來利滾利,坦白說很難滾起來的。

⠀

因為你的雪球太小,小雪球還是有價值沒錯,但不多。

⠀

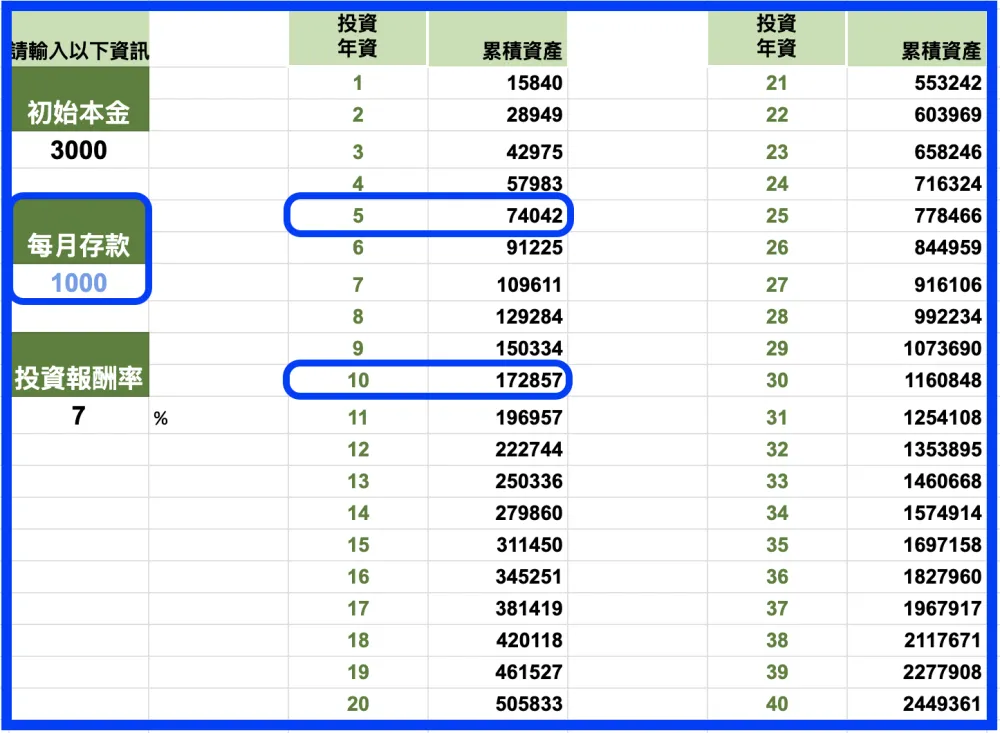

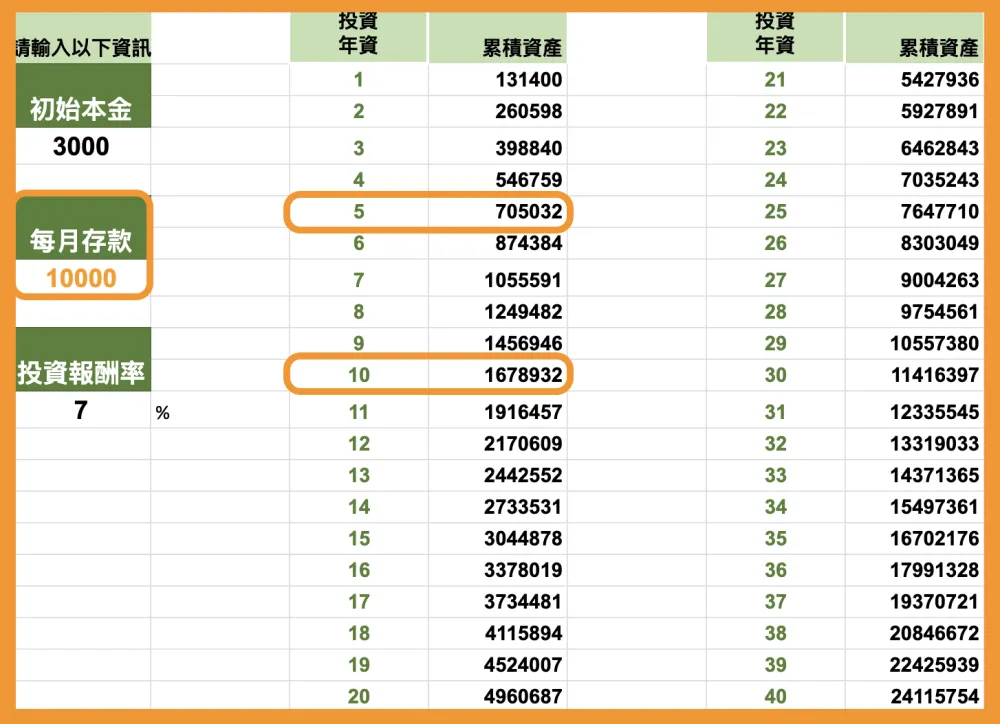

藍色:每月投1,000元,每年投報率 7 %,滾 5 年累積資產是 7 萬多,滾 10 年,是17萬。

⠀

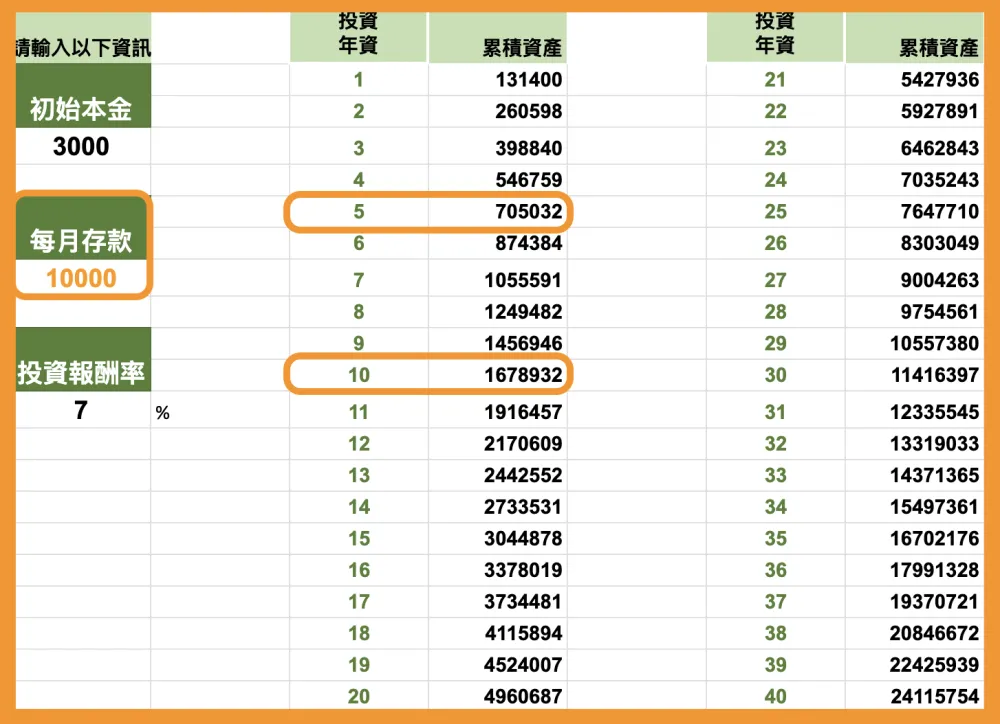

橘色:每月多投一個零,變10,000元,每年投報率 7 %,滾 5 年累積資產是 70 多萬,滾 10 年,是 167 萬。

(感謝書廷製作的 Excel 表格,超好用!)⠀

當時間越拉長,差距會越誇張。

⠀

所以增加收入、增加儲蓄率很重要。

⠀

我知道不可能每年投報率都固定 7 %,每次投的金額也會不一定,但這圖表可以很清楚知道「金額、時間、複利」三者的關係。

⠀

投同一個市場、同一個時間開始投,你金額越大,經過時間、經過複利,資產就是會更可觀。

⠀

書中提供四種增加收入的方法

⠀

⠀

▋第1種收入:出售你的時間 / 專長

⠀

我的理解就是「領時薪的工作」

⠀

名言「時間就是金錢」,所以你可以賣你的時間或技能,賺取金錢。但別急著隨意找個領時薪打工機會,頭就洗下去!

⠀

你可以先研究一下,找出最能善用你技能或你有偏好的領域來做,一開始可能無法幫你賺很多錢,但隨專業增加,你可以提高你的收費。

⠀

如書中所說,一小時的工作等於一小時的收入,不會更多,所以,只靠著出售你的時間,永遠無法使你變得極富有。

⠀

但從出售你的時間著手,沒有不對,它非常好入手,但不會是你最終目標。

⠀

利:容易做,啟動成本低

⠀

弊:時間有限,無法擴大規模

⠀

⠀

▋第 2 種收入:出售一種技能/服務

⠀

這類型的收入,我的理解就是大家常說的「接案 」。

⠀

比起出售時間,出售一種技能或服務(攝影 / 設計)可以賺更多,因為你出售不是和你的時間直接關聯的東西。若你建立起品牌,還有機會取得較高的價格。

⠀

但跟出售時間一樣,出售個人技能或服務難以擴大規模,因為你必須親自提供每件服務,時間還是被綁著。

⠀

也許你會想,那我就雇用或外包他人啊,給別人做啊?但這牽涉到「他人」就會相對較複雜些。

⠀

利:收入較高,能建立一個品牌。

⠀

弊:需要投資時間於發展可出售的技能/服務;不容易擴大規模

⠀

⠀

▋第 3 種收入:教課

⠀

亞里斯多德:「知者,做;識者,教。」

⠀

「你能教什麼呢?」

⠀

我喜歡作者簡單粗暴的說:「凡是人們願意付錢學習的東西都行」

⠀

教人拍照、變漂亮、瘦身、寫作、變健康、如何開啟副業….例子超級多!

⠀

教學(尤其是在線上教學),是賺取可擴增規模收入的最佳途徑之一。

⠀

利:容易擴增規模

⠀

弊:很多競爭對手,吸引學生可能是一場打不完的仗

⠀

⠀

▋第 4 種收入:銷售一種產品

⠀

找出他人尚未解決的問題,然後打造出解決問題的產品。

⠀

這問題可能是情緒性質、心理性質、實體性質或財務性質。

⠀

你只需要打造產品一次,卻可以銷售許多次,尤其是線上產品更是如此!例如:電子書、線上錄播課程、手機 app 軟體。

⠀

《那瓦爾寶典》中提到的三大槓桿:人力槓桿、資本槓桿、自媒體/coding 槓桿(零邊際成本的產品或服務)

⠀

這裡就屬於第三種槓桿:零邊際成本的產品或服務

⠀

例如:你製作一款手機 app 軟體,你每賣給一個人,你賺了錢卻不會增加太多成本。

⠀

但如書中所說「打造產品將需要很多的前置投資,還需要費更大心力去銷售它。打造產品不是易事,但若你做得出一種受人們喜愛的產品,可以在很長一段期間靠它賺錢。」

⠀

利:可擴增規模

⠀

弊:需要大量的前置投資和持續的行銷工作

⠀

⠀

▋以上方法都是暫時性質,最終目標是所有權

⠀

「不論你想怎麼增加未來的收入,上述所有方法都應該被視為暫時性質,因為最終,你賺得的更多收入應該被用來投資於更多的生財資產。這才是大大增加你的儲蓄的真正途徑。」

⠀

「理查森變得超級富有的,不是他的勞力所得,而是他投資事業的所有權,我希望你以這種方式去思考如何增加你的收入。是的,出售你的時間、技能或產品,這些都很好,但這不該是你創造財富旅程的最終目標,你的最終目標應該是所有權——用你增加的收入去取得更多的生財資產。 不論這意味的是投資於你自己或是別人的事業,你必須把你的人力資本轉化為財務資本,以創造長期財富。」

⠀

投資自己的事業,我想到的是把賺到的錢,再投回自己的事業去優化。

⠀

投資別人事業,我想到最簡單直接的方式,就是買股票。

⠀

⠀

▋好書推薦《持續買進》

以上內容:摘錄自 《持續買進》+自己的讀書心得筆記

4 Ways to Earn — But Ownership Builds Wealth

This week, I read “Just Keep Buying”.

The book is divided into two main parts: saving and investing.

After finishing the first part about saving,

I was especially impressed by the section on how to increase income.

(Technically speaking, I should say "listened," because lately, I’ve been really into audiobooks, haha! But I also have the ebook, so after finishing a chapter while on the treadmill, if I’m curious to explore more, I’ll go home and read that section again on my computer — this is my current reading habit.)

Anyway, back to the point:

After introducing four ways to make money,

the author clearly states — don't treat these as the end goal. These are temporary strategies. The real goal is to increase your income so you can invest more in “income-generating assets.”

Whether you're investing in your own business or someone else's,

you need to shift your mindset from “human capital” to “financial capital.”

That’s how you build long-term wealth.

For me, this was a very important reminder!

It’s so easy to get stuck in the work itself,

and forget about this bigger mindset shift and the importance of investing.

Saving vs. Increasing Income

If you’re currently earning a low income,

the simplest and most effective way to save more is to increase your income.

If your income is low, don’t focus on cutting expenses — focus on earning more!

When you have little money but keep cutting back, your quality of life drops, your motivation plummets, and you risk falling into a vicious cycle where you have no energy to make more money — and end up with even less.

Saving vs. Investing

If you don’t have any savings,

then no matter how much investing knowledge you gain or how motivated you are, or even if you plan your asset allocation carefully,

honestly — it’s hard to get compounding returns to really work for you.

Because your snowball is too small.

A small snowball still rolls, but not by much.

Example:

Blue line: Invest 1,000 NT per month, 7% annual return → after 5 years ~ 70k NT, after 10 years ~170k NT.

Orange line: Invest 10x (10,000 NT per month), 7% annual return → after 5 years ~700k NT, after 10 years ~1.67M NT.

(Thanks to Shuting for the super handy Excel sheet!)

The longer the time horizon, the bigger the difference.

That’s why increasing income and increasing savings rate is so important.

Of course, returns won’t be exactly 7% every year, and monthly amounts may vary, but this chart clearly shows the relationship between amount invested, time, and compound interest.

If two people start investing in the same market at the same time,

the one who puts in more money — after time and compounding — will naturally build greater wealth.

Four Ways to Increase Income (from the book)

1. Selling your time / skills

In my understanding — this is "hourly wage" work.

The saying “time is money” applies here — you exchange time or skills for money.

But don’t just take any hourly job — first think carefully:

How can you best use your skills or personal interests?

At first, this might not earn you much, but as your expertise grows, you can charge more.

As the book says: one hour of work equals one hour of income — no more than that.

So just selling time alone won’t make you rich.

However, it’s still a good entry point — just not the final goal.

Pros: easy to start, low upfront cost

Cons: limited by time, can’t scale

2. Selling a skill/service

This is what people often refer to as "freelancing."

Compared to selling time, selling a skill or service (photography, design, etc.)

allows you to earn more — because it’s not tied directly to hours.

If you build a personal brand, you can charge higher fees.

But like selling time, freelancing is hard to scale, because each service still requires your personal time and effort.

Of course, you can hire or outsource, but managing people is more complex.

Pros: higher income potential, opportunity to build a brand

Cons: need time to develop marketable skills/services; scaling is difficult

3. Teaching

Aristotle said: “Those who know, do; those who understand, teach.”

What can you teach?

I love the author's blunt advice: "Anything people are willing to pay to learn."

Examples: photography, beauty, fitness, writing, health, starting a side business — endless possibilities!

Teaching (especially online teaching) is one of the best ways to earn scalable income.

Pros: easy to scale

Cons: lots of competition — attracting students can feel like a never-ending battle

4. Selling a product

Find an unmet need — then create a product to solve it.

This could be an emotional, mental, physical, or financial problem.

You only need to create the product once, but you can sell it repeatedly — especially true for digital products like ebooks, online courses, apps, etc.

In “The Almanack of Naval Ravikant”, he mentions three kinds of leverage:

Labor

Capital

Code/media (products with zero marginal cost)

This belongs to the third type of leverage — products/services with zero marginal cost.

For example, if you build an app, each new sale brings in income with almost no extra cost.

But as the book notes — building a product requires lots of upfront work and ongoing marketing.

It’s not easy — but if you can create something people love, it can generate income for a long time.

Pros: highly scalable

Cons: requires significant upfront effort and ongoing marketing

All these methods are temporary — the ultimate goal is ownership.

"No matter how you choose to increase your income, these methods should all be viewed as temporary — because ultimately, your increased income should be used to invest in more income-producing assets. That is the real path to significantly growing your savings."

"What made Richardson truly wealthy wasn’t labor income — it was ownership of businesses he invested in. I hope you will think about increasing your income in this way. Selling your time, skills, or products is great, but this should not be the final goal.

The ultimate goal is ownership — using your growing income to acquire more income-producing assets."

Whether that means investing in your own business (reinvesting profits),

or investing in others’ businesses (like buying stocks) —

you need to turn human capital into financial capital to build long-term wealth.

Highly recommend this book → Just Keep Buying

The above is a combination of excerpts from “Just Keep Buying” and my personal reading notes.

Hi ,大家好,我是展展 Betty.

一位喜歡用文字與攝影,記錄生命成長的人.

是一名登山嚮導,喜歡多元,所以除了爬山外,現在關注主題 AI、投資理財、變美

▪️ 喜歡書寫的主題:生命體悟、親密關係、親子關係、個人成長、讀書心得、金錢思維、哲學思考